The Outlook for Township and Rural Retail Developments in South Africa for 2025

- Cuma Dube

- Mar 2, 2025

- 2 min read

South Africa's retail landscape is undergoing a significant transformation, with township and rural retail developments poised to play a pivotal role in the country's economic recovery and growth. As we move through 2025, these developments are not only reshaping consumer access to goods and services but are also creating opportunities for job creation, local economic stimulation, and infrastructure development. Below, we delve into the key trends, challenges, and opportunities shaping this sector.

In recent years, South Africa has witnessed a growing interest in retail developments targeted at underserved township and rural areas. Developers are increasingly recognising the untapped potential of these markets, which were historically overlooked in favour of urban centres. This shift is evident in projects like the R3 billion Dan City mixed-use development in Limpopo, which includes a 36,000 sqm mall designed to meet the needs of local communities while reducing travel costs for essential goods.

Similarly, developers like Abland are focusing on semi-rural regions with projects such as the Groot Phesantekraal Shopping Centre in Durbanville and smaller malls like the Mopane View Retail Mall project Soshanguve. These initiatives aim to bring modern retail experiences closer to home for residents who previously had to travel long distances.

Several factors are driving the expansion of township and rural retail developments. South Africa's economic outlook has improved following a series of interest rate cuts in late 2024 and early 2025. Inflation has stabilised at 3%, boosting disposable income and encouraging consumer spending. Retail trade sales increased by 7.7% year-on-year in November 2024, with general dealers contributing significantly to this growth.

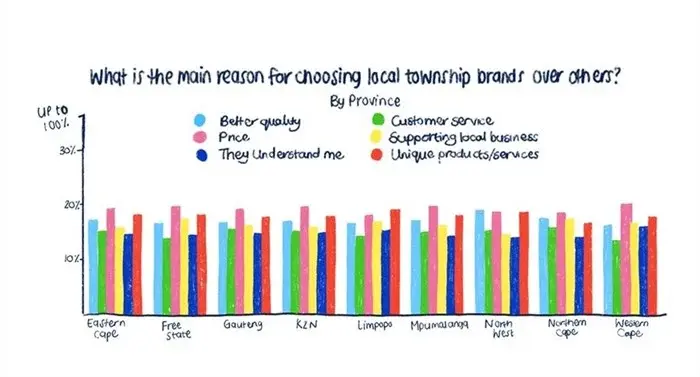

Township economies thrive on accessibility and affordability. Retail centres in these areas provide residents with essential goods and services while reducing transportation costs. For example, the Dan City Mall will save residents up to R100 on taxi fares per trip. Township consumers value brands that resonate with their communities. Developers are incorporating culturally relevant designs and tenant mixes into their projects to align with local preferences. Interestingly, E-commerce is gaining traction in townships, with 40% of residents shopping online in 2024—a significant increase from previous years.

Despite their potential, these developments will continue to face several challenges. For example, high unemployment rates and limited access to credit remain barriers for many township residents. Innovative payment solutions like "buy now, pay later" systems are helping to address this issue but require further scaling. Reliable electricity and internet connectivity are critical for modern retail environments but remain inconsistent in rural areas.

The outlook for township and rural retail developments in South Africa is optimistic. As developers continue to invest in these underserved areas, they are not only meeting consumer demand but also contributing to broader socio-economic goals such as job creation, infrastructure development, and poverty alleviation.

By adopting innovative approaches that combine digital integration, sustainability, and hyper-localisation, township retail centres can become vibrant hubs of economic activity while preserving their unique cultural identities.